The TaxCaddy platform allows us to seamlessly communicate, upload, and review documents with our clients.

To log onto TaxCaddy click here.

Platform Benefits

- Provided at no cost to you.

- In order to complete your return, your account will reflect information that is outstanding.

- You will have access to your tax professional through messaging features.

- You can submit documents by taking pictures with the mobile app, uploading files, or manually entering information.

- For greater convenience, you will also have the option of authorizing TaxCaddy to retrieve documents automatically from your financial institutions which will give us access to them immediately.

Having Trouble Picturing the Process?

Here is a video tutorial to show you what to expect each step of the way: Getting Started with TaxCaddy

Frequently Asked Questions

How easy it is to sign up?

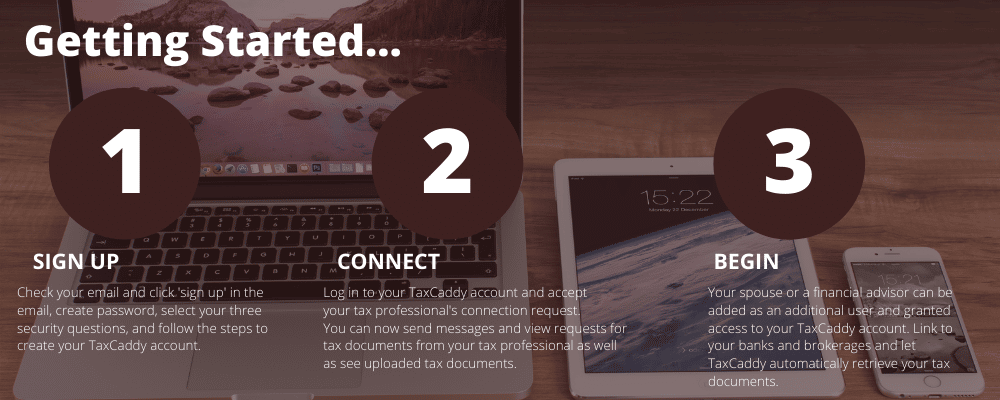

In order to sign up, you will receive an invitation from NoReply@taxcaddy.com inviting you to sign up. Once you follow the directions in the email, there will be 3 simple steps to follow. Note: The email you use is specific to your individual account and can only be used once.

Is TaxCaddy secure?

TaxCaddy has been independently audited, tested, and validated by C-Level Security, LLC. The C-Level Certified Seal verifies that TaxCaddy employs the strictest security steps for safeguarding your data. In addition, TaxCaddy uses Amazon Web Services for secure, reliable storage. Your documents are encrypted in transit and at rest using Amazon’s best-in-class Secure Socket Layer and Server Side Encryption technologies.

How do I upload a document?

You can upload documents in a variety of ways. 1.) Taxcaddy.com upload feature 2.) Through your smartphone or tablet by simply taking a picture. With this feature, you must have an internet connection.

Who can I contact if I need assistance?

If you have any issues or need help accessing documents please contact your tax professional. You are able to communicate with them through the platform or email us at info@barneswendling.com.

What tax returns can I upload?

We are currently only working with individual tax returns. The questions asked on the platform and from your tax professional are all specific to individual tax returns.

Can I sign documents in TaxCaddy?

While TaxCaddy offers this feature, Barnes Wendling uses SafeSend Returns for secure delivery of your tax return. Since TaxCaddy is integrated with SafeSend Returns, once you sign your e-file authorization forms, a copy of your tax return will automatically be added to your TaxCaddy account. Click here to learn more about SafeSend.

Interested to Learn More?

If you have any additional questions, please feel free to contact our office at 216-566-9000 or complete the below form. You may also find assistance through TaxCaddy’s Knowledge Base.