Fraud Prevention: Having A Plan

Growing up in northeast Ohio, I’ve never actually seen a tornado up close or personally know anyone affected by a tornado touching down in the area. Even still, when a tornado watch alert is issued, I keep a close on eye on the weather for changing conditions and I stay close to home if possible. Even in the smallest of ways, a simple thing such as a tornado watch in an area where we just don’t see many tornadoes, if any, causes us to prepare for one. This made me start thinking about the fraud triangle and why fraud occurs in organizations, which then led me to my question for all of you: “Should you issue a fraud watch within your organization?”. If so, how are you preparing for the fraud tornado?

Utilizing Fraud Triangle for Fraud Prevention

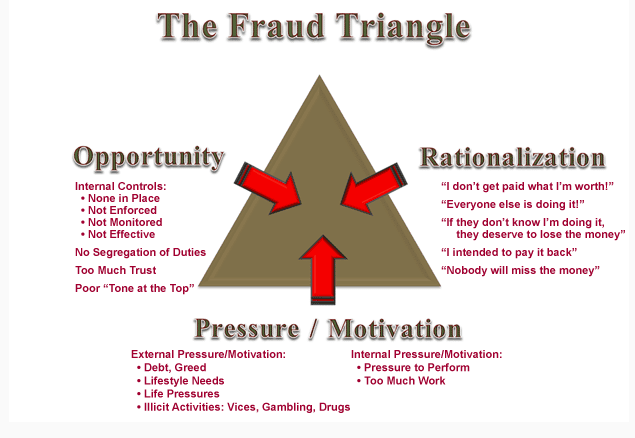

Let me back up for just a moment to explain the connection. The Fraud Triangle consists of three elements:

- Opportunity

- Pressure

- Rationalization

When these elements are present, fraud can occur. Similar to a tornado watch, when the right weather conditions are present, a tornado can occur. While local weather professionals are charged with identifying if all the right weather conditions are present to issue a tornado alert, who in your organization is doing the same to determine if the conditions in your organization are right for fraud? Many individuals in leadership roles at organizations don’t look at all elements of the triangle in a comprehensive manner to identify fraud risks. Rather, there may be times when internal controls are evaluated and certain measures are taken to strengthen those controls. Other times, organizational goals/metrics will be re-evaluated to determine what makes sense in the present economy so as not to create undue pressure on the system. Rarely, however, does anyone look at all three elements at the same time and ask themselves, “Are there conditions present within our organization that we should be under a fraud watch?”.

Who Can Commit Fraud?

The chart below provides examples of what each of these elements means. In working with middle market, privately held companies, and non-profit organizations, I encounter this typical scenario: limited personnel in key roles with minimal segregation of duties and organizations trying to do more with less. If you begin to add significant amounts of trust and an employee under financial distress, experiencing other life pressures, or simply overworked in their current position, your triangle is complete. I’ve often heard, “I’m doing the job of two people” or “I don’t know why I do this job for what I get paid?” Don’t be lulled into a false sense of security that your long-tenured, trusted employee(s) would never steal from you. According to the ACFE’s 2020 Report to the Nations, 41% of cases involving fraud were committed by employees and 35% were committed by managers, with median losses over $200,000. Getting that feeling in the pit of your stomach? Then maybe you should be re-evaluating your situation. In Part II of my blog, I’ll provide ways for you to further evaluate the elements of the fraud triangle.

(Chart: Association of Government Accountants)

Related Insights

Featured Client Testimonials

BW is a true partner to us. Their knowledge, expertise, and service are a valuable resource to us and play an important role in our success!

John Allen - Vice President of Finance, Kaufman Container

Featured Client Testimonials

I appreciate the exceptional tax advice we received over the years. The (BW team) has a good grasp of our business needs. Thank you for your excellent service.

John Griffiths - Owner, Rae Ann, Inc.

Featured Client Testimonials

The BW team has been fantastic to work with; both the team member at our office as well as at the partner level. Any issues or concerns are handled very efficiently and effectively.

Kelley Needham - Chief Executive Officer, Epilepsy Association

Featured Client Testimonials

Barnes Wendling has been our company accountants for over seven years. Their knowledge has been instrumental in helping us grow strategically during this time. And although we’ve seen many changes in our economy that we cannot control, we’ve always been able to trust the Barnes team to be by our side. The Barnes team feels like family. We can’t thank them enough for their support!

Christine Kloss - Controller, AT&F

Featured Client Testimonials

Barnes Wendling has been our company accountants for over 15 years. During this time, the business has grown exceptionally, and Barnes has kept pace, providing accurate, quality advice. Our finances are more efficient than ever, and the expense of hiring Barnes has been a definite positive add to our bottom line. I give my highest recommendation to their firm.

David Miller, MD - President, Retina Associates of Cleveland

Featured Client Testimonials

Barnes Wendling has provided us guidance and recommendations that have strategically helped strengthen our business and position ourselves for growth. We needed to hire a new VP of Finance and Controller this past year, and they were instrumental in helping us find the best candidates for our company.

Sara Blankenship - President, Kaufman Container

Featured Client Testimonials

We value the trust, accuracy of information, and reliability of Barnes Wendling and Mike Essenmacher personally. Mike has been instrumental as a trusted advisor on accounting, tax, and personnel issues. His advice is always accurate, and he is very reliable. His associates are also very talented.

Dominic Ozanne - President and CEO, Ozanne Construction Company

Featured Client Testimonials

We value Barnes Wendling’s expertise with all things accounting so we can operate our business using our strengths and allowing them to be our experts. They have also brought me a few business sale opportunities to allow me to grow my assets.

John Gaydosh - President and Metallurgical Engineer, Ohio Metallurgical Service

Featured Client Testimonials

Barnes Wendling (especially Lena) did a great job with our financials. Everything. It is extremely refreshing and comforting to know that all of our numbers are not only correct, but they are in the right place(s). Your diligence and reporting truly does make me (personally) feel better.

Thomas Adomaitis - Controller, Bialosky Cleveland

Featured Client Testimonials

I can wholeheartedly tell you that I have yet to work with an audit or tax team that have been more helpful, easy to work with, and committed than the team at Barnes Wendling- I have been through three different firms in the last few years.

Michelle Saylor, Former Controller, Aero Mag

Featured Client Testimonials

Floyd Trouten at Barnes Wendling CPAs is an “expert’s expert” when it comes to M & A accounting. Not only does he understand the evolving details of the Tax Code but he also sees the fine points of their application for owners, managers, investors, and financiers.

Mark A. Filippell, Western Reserve Partners

Featured Client Testimonials

The service is amazing at Barnes Wendling CPAs. The benefit is worth more than the cost. Sometimes it’s true that you get what you pay for.

Mark Boucher - Former Owner, Castle Heating & Air